Overview of Vietnam's Dairy Market in 2024

I. Market size & growth

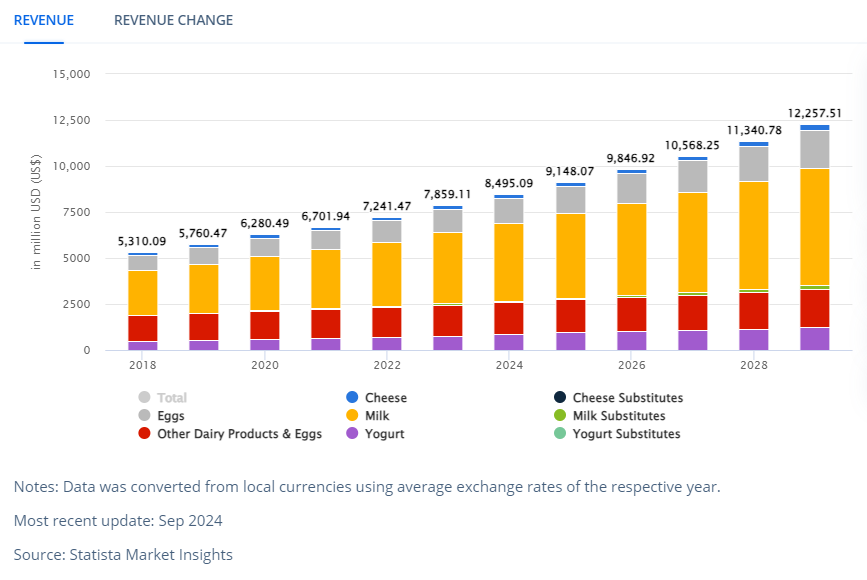

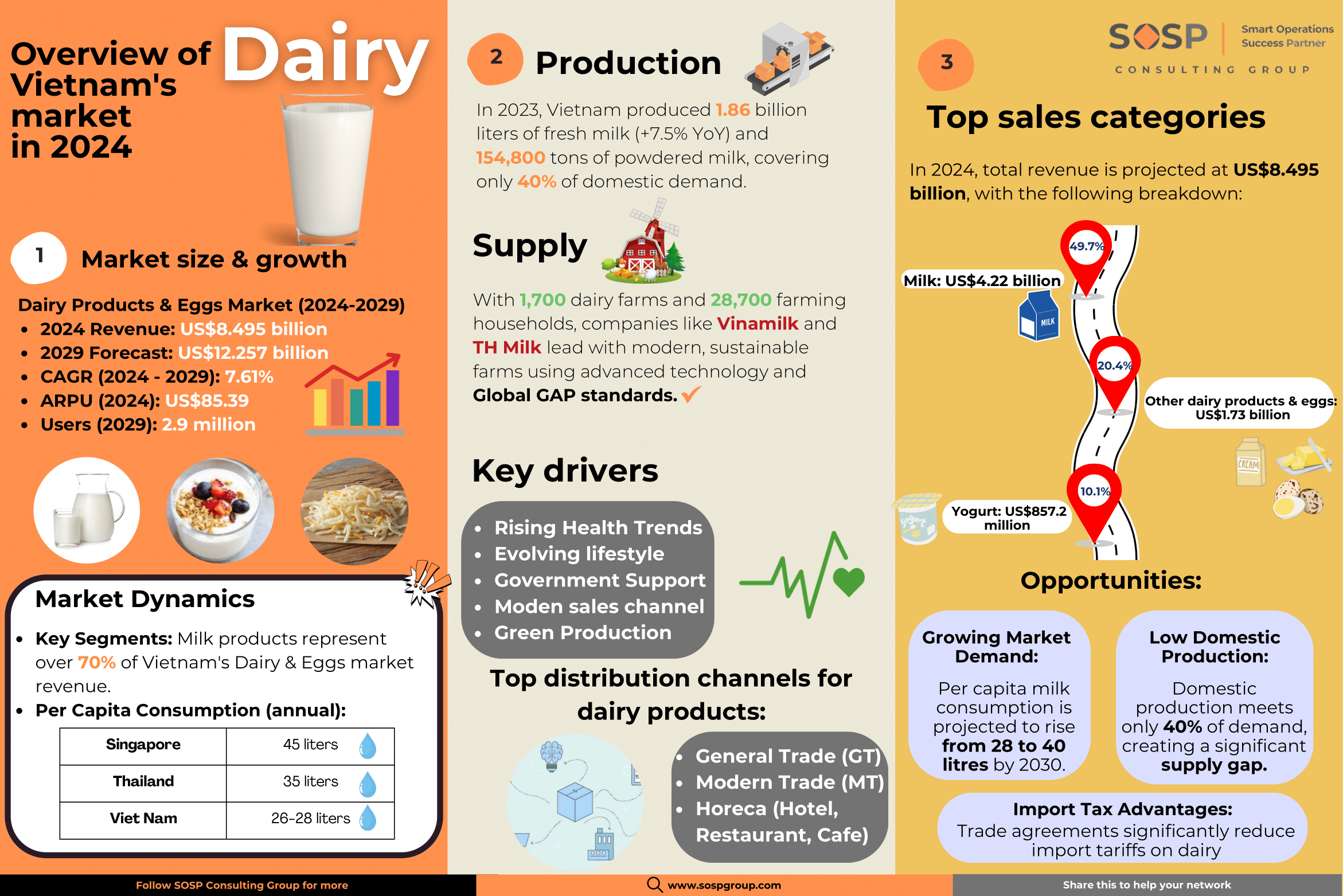

Vietnam's dairy sector is on a robust growth trajectory, driven by rising consumer demand, economic development, and supportive government policies. According to a recent report by Statista (Sep 2024), the Dairy Products & Eggs market in Vietnam is projected to generate US$8.495 billion in revenue in 2024, with an annual growth rate (CAGR) of 7.61% from 2024 to 2029. By 2029, the total market is projected to reach US$12.257 billion, the market volume is expected to reach 4.211 billion kg, driven by rising health awareness and changing consumer preferences.

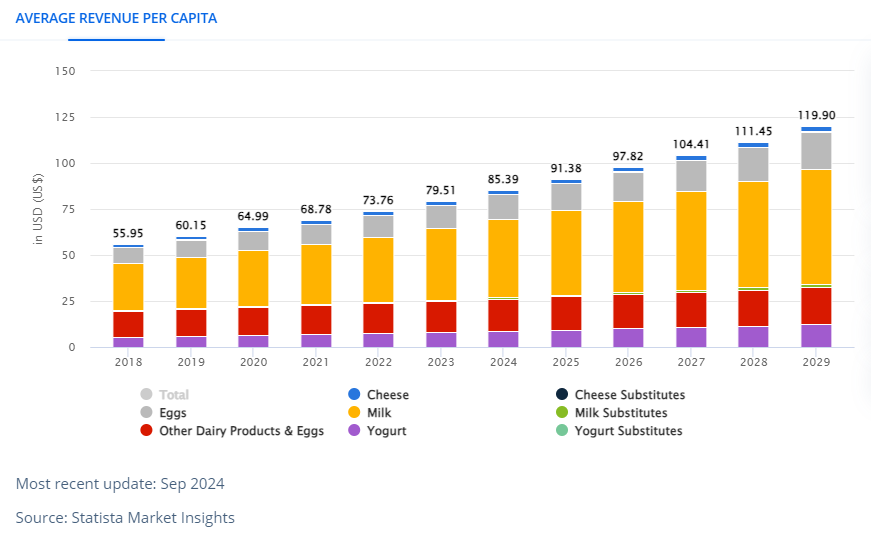

In terms of per capita metrics, the average revenue per person in 2024 is expected to be US$85.39, with an average consumption volume of 33.9 kg per person. These figures indicate a promising opportunity for expansion, particularly as consumer preferences shift towards health-conscious and premium dairy products.

Market Dynamics

- Key Segments: Milk products continue to dominate the market, accounting for approximately 70% of total Dairy & Eggs revenue. This includes both liquid and powdered milk, yogurt essential staples in the Vietnamese diet.

- Per Capita Consumption: Despite impressive growth, Vietnam’s per capita milk consumption remains relatively low at around 28 liters per year, compared to 35 liters in Thailand and 45 liters in Singapore, suggesting significant potential for future growth.

Production and Supply

In 2023, Vietnam produced around 1.86 billion liters of fresh milk, up 7.5% from the previous year. Powdered milk production increased slightly, reaching approximately 154,800 tons. According to Mr. Tran Quang Trung, Chairman of the Vietnam Dairy Association, local milk production covers just 40% of the country's needs. This gap highlights the potential for substantial growth, particularly as health and nutrition awareness rises.

Vietnam's dairy industry is committed to sustainability, with a focus on modernizing the value chain through "green production" initiatives such as achieving net-zero emissions, adopting renewable energy, and planting large-scale forests. With over 1,700 dairy farms and approximately 28,700 dedicated farming households, the industry is increasingly relying on advanced farming techniques and efficient industrial processes. Leading companies like Vinamilk and TH Milk are setting the benchmark by operating modern dairy farms that comply with Global GAP standards, utilizing automation and cutting-edge technology to create sustainable, closed-loop systems from pasture to production.

II. Key drivers

Several critical factors make Vietnam a highly attractive investment destination:

- Rising Health and Wellness Trends: Vietnam’s focus on health and nutrition is becoming more prominent, with consumers increasingly seeking healthier food options for dairy products like organic milk, low-fat alternatives, and fortified ones.

- Urbanization and Evolving Lifestyles: Vietnam is experiencing rapid urbanization, with approximately 40% of its population now living in urban areas. This urban shift is changing dietary habits, with Westernized diets gaining popularity, integrating cheese and yogurt into their daily meals.

- Supportive Government Policies: Vietnam’s government continues to attract foreign direct investment (FDI) with initiatives like tax incentives, improved infrastructure, and regulatory reforms. As of September 2024, Vietnam attracted approximately $24.78 billion in foreign direct investment (FDI) during the first nine months of the year, marking an 11.6% increase year-on-year.

- Advances in Modern Sales Channels: With the rapid growth of e-commerce and modern retail formats, Vietnam's dairy industry has benefited from improved access to consumers. Supermarkets, convenience stores, and online platforms are expanding, making it easier for dairy products to reach a wider audience, especially in urban centers.

- Adoption of Clean Energy Solutions: It is expected that a significant portion of Vietnam’s dairy farms will increasingly adopt clean energy solutions in the coming years, reflecting the industry's commitment to sustainability and modernization. Leading companies in the sector, such as Vinamilk and TH Milk, are at the forefront of this transition.

- Commitment to Net-Zero Emissions: Vinamilk and TH Milk are actively pursuing initiatives aimed at achieving net-zero emissions by 2050. Both companies are implementing various strategies, including the adoption of renewable energy and sustainable farming practices, to reduce their environmental impact and contribute to a more sustainable dairy industry in Vietnam.

III. Potential investment areas for SME in Vietnam’s Dairy sector

A) Investment Opportunities for Solopreneurs & SMEs in Vietnam's Dairy Sector

While large corporations dominate the sector, there are still several low-cost, high-potential pathways for smaller businesses to make a mark. By leveraging local partnerships, flexible distribution channels, and modern digital platforms, foreign solopreneurs and SMEs can effectively penetrate Vietnam’s dairy market with relatively modest investments. Below are key entry strategies that cater specifically to these businesses:

Partnering with Local Distributors for Product Imports and Distribution

By partnering with established local distributors, solopreneurs and SMEs can tap into Vietnam’s extensive distribution networks without the need for heavy upfront investment in infrastructure:

- General Trade (GT): This channel involves distributing dairy products through traditional outlets like neighborhood grocery stores, street markets, and small independent retailers.

- Modern Trade (MT): For businesses looking to target urban, middle-income consumers, the MT channel offers access to large supermarket, hypermarket, convenience stores chains such as MegaMarket, Big C and Circle K. These organized retail outlets provide a more formal and scalable distribution model, helping businesses to establish a consistent and recognizable presence in the market.

- Horeca (Hotels, Restaurants, Cafes): The Horeca channel is ideal for businesses that want to supply dairy products to the growing food service sector in Vietnam. Distributors like Annam Gourmet and New Viet Dairy specialize in delivering premium dairy products to high-end restaurants, hotels, and cafes, which are seeing rising demand for Western-style dairy items like cheese and yogurt.

Establishing a Small-Scale Subsidiary

For solopreneurs and SMEs that want a more hands-on approach, setting up a small-scale subsidiary in Vietnam provides the opportunity to build a local brand and control sales activities. This method is more involved but allows for greater flexibility and a deeper market presence. A small subsidiary can engage in:

- Offline Retail Partnerships: Businesses can establish relationships with local retailers and participate in promotions or exclusive in-store deals. This helps to boost brand visibility and directly reach consumers in key locations.

- E-commerce Expansion: Vietnam’s e-commerce sector is booming, and platforms like Shopee and Tiktok Shop provide cost-effective ways to reach consumers nationwide. By listing products on these digital platforms, solopreneurs and SMEs can bypass traditional retail channels altogether, reducing operational costs while gaining access to a growing online customer base.

These strategies allow smaller businesses to enter Vietnam’s competitive dairy market while minimizing financial risk. Through careful planning and the right partnerships, solopreneurs and SMEs can carve out a niche in this rapidly developing industry.

B) Top sales products in dairy sector

Vietnam’s dairy market is projected to generate total revenue of US$8.495 billion in 2024, with significant growth across multiple product categories:

- Milk: As the dominant category, milk is projected to generate US$4.22 billion, accounting for 49.7% of the total revenue in 2024.

- Other Dairy Products & Eggs: This category contributes US$1.73 billion, representing 20.4% of the total revenue. This covers other products made from milk or milk components and other types of edible eggs (besides chicken eggs): Butter, cream, whey products, lactose-free dairy products, eggs from different species (duck eggs, quail eggs).

- Yogurt: Yogurt contributes US$857.2 million, making up 10.1% of the total revenue, a significantly larger share than cheese.

According to Statista (Sep 2024), Vietnam’s dairy industry is projected to achieve an average revenue per capita of $85.39 in 2024. The milk category, represented in yellow, continues to lead the market, contributing approximately $42.42 per capita, highlighting the sustained strong demand for milk products. Following milk is Other Dairy Products & Eggs, contributing $17.42 per capita, which represents a significant portion of the market. Yogurt, the second most popular dairy product after milk, contributes $8.62 per capita, indicating steady growth in consumer interest in fermented dairy products.

IV. Opportunities and Challenges in Joining the Dairy Sector in Vietnam

Vietnam's dairy sector offers substantial opportunities for foreign direct investment (FDI), especially for solopreneurs and small to medium-sized enterprises (SMEs). The market is expanding rapidly, driven by increasing demand for dairy products, making it an attractive entry point for investors. However, navigating the landscape comes with its own set of challenges that must be managed effectively.

Opportunities

- Growing Market Demand: Vietnam's per capita milk consumption is projected to rise from 28 liters in 2021 to 40 liters by 2030, indicating a significant 40% increase in demand. This growth is fueled by an expanding middle class and heightened health awareness among consumers.

- Low Domestic Production: Currently, domestic milk production meets only about 40% of the country's demand. In 2024, Vietnam produced approximately 1.2 million tons of milk while importing over 4 million tons, revealing a critical opportunity for local production to fill the supply gap.

- Diverse Product Segmentation: There is a growing consumer interest in a variety of dairy products, such as yogurt, cheese, and butter, influenced by shifting dietary preferences toward Western foods. This trend presents avenues for SMEs to introduce niche products with relatively lower investment requirements.

- Government Initiatives: The Vietnamese government actively promotes dairy consumption through initiatives like the School Milk Program, which aims to provide daily milk to children. These programs create a stable demand base for dairy products and encourage investments.

- Import Tax Advantages: Under the EU-Vietnam Free Trade Agreement (EVFTA) and trade agreements with countries like New Zealand and Australia, import tariffs on dairy products originating from these regions are significantly reduced. This provides a competitive advantage for foreign producers looking to enter the market, facilitating access to high-quality dairy products at lower costs.

- Technological Advancements: The sector is witnessing significant investments in modern processing technologies, enabling smaller players to compete effectively without large upfront costs. Innovations in production can lead to improved quality and operational efficiency.

Challenges

Understanding Local Insights: New entrants may struggle to grasp local consumer preferences and market dynamics. Developing a deep understanding of Vietnamese taste profiles is essential for product acceptance.

- Intense Competition: The market is dominated by established local brands, such as Vinamilk, which holds substantial market share. This creates a challenging environment for newcomers, requiring effective and strategic marketing initiatives to establish brand presence.

- Sales Price Competition: The dairy sector is characterized by fierce price competition, with companies frequently engaging in constant promotional discounts to attract consumers. This can lead to reduced profit margins, making it difficult for SMEs to sustain profitability.

- High Marketing Costs: Establishing a brand in a competitive market necessitates significant investment in marketing activities, which can strain the budgets of smaller enterprises.

- Regulatory Hurdles: Navigating the complex regulatory landscape in Vietnam can be daunting for foreign investors. A thorough understanding of local laws related to food safety and quality standards is critical and may require additional resources and expertise.

- Market Volatility: Economic fluctuations and evolving consumer spending habits can affect demand for dairy products. For instance, during economic downturns, consumers may prioritize essential goods over non-essential dairy items, impacting sales.

- Supply Chain Challenges: Establishing reliable supply chains for raw materials is often difficult, particularly in a market where domestic production is limited and heavily reliant on imports.

V. Tips for FDI Solopreneurs and SMEs Entering Vietnam's Dairy Market

Entering Vietnam's dairy market requires a strategic approach grounded in a deep understanding of the local landscape. Here are essential tips for success:

- Understand Consumer Insights: Grasp the shift towards health-conscious and premium dairy products, including Western-style options like cheese and yogurt. Offer affordable choices to address price sensitivity, especially in rural areas.

- Leverage Local Knowledge: Partner with local experts or hire in-country talent to navigate cultural nuances and regulatory requirements effectively.

- Start Small, Then Scale: Test products in select regions before committing significant resources. This approach allows for refinement based on consumer feedback.

- Focus on Marketing and Branding: Build a strong brand that emphasizes quality and health benefits. Engaging storytelling can foster trust and loyalty.

- Utilize Digital Marketing: Implement a robust digital marketing strategy across social media and local platforms to enhance visibility and reach your target audience.

- Strategic Pricing: Conduct market research to determine pricing strategies that align with consumer behavior and local conditions, ensuring competitiveness while maintaining profitability.

By focusing on these strategic elements, FDI solopreneurs and SMEs can navigate the complexities of Vietnam's dairy market, positioning themselves for successful entry and sustainable growth.

CONCLUSION

Vietnam’s dairy industry presents substantial opportunities for foreign direct investment (FDI) solopreneurs and small to medium-sized enterprises (SMEs). The market is characterized by a rapidly expanding consumer base, increasing health consciousness, and favorable government support, making it an opportune time for investors to explore entry strategies. Whether your focus is on premium dairy products, e-commerce solutions, or plant-based alternatives, Vietnam offers significant growth potential and access to broader regional markets.

Need tailored research for your specific product and business?

If you’re considering an investment in Vietnam’s dairy sector, book a call with SOSP Consulting Group. We specialize in providing customized market research and comprehensive market entry services designed to meet your unique needs and context.

Reference:

https://www.statista.com/outlook/cmo/food/dairy-products-eggs/vietnam#revenue (Sep 2024)

https://en.vneconomy.vn/vietnams-dairy-market-bridging-the-gap-for-growth-and-innovation.htm

https://vietnamagriculture.nongnghiep.vn/vinamilk-is-on-the-list-of-fortune-southeast-asia-500-d390462.html

https://www.customs.gov.vn/